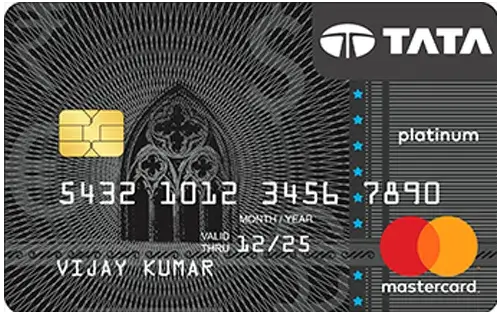

SBI Tata Platinum Card

Apply Now

Joining Fee

Renewal Fee

Best Suited For

Reward Type

|

Welcome Benefits

Movie & Dining

NA

Rewards Rate

You can upto 3 Empower points on Dining, Departmental & Grocery shopping, and International spends. You get 1 Empower point on every Rs 100 spent on other retail categories. You earn 1 Empower point on every Rs 100 spent on retail stores

Reward Redemption

1 Empower Point = Rs. 1 can be redeemed against the Tata Loyalty program- The Empower Program or you can simply redeem your reward points at TATA merchant outlets.

Travel

Complimentary lounge access in India at select airports

Domestic Lounge Access

8 complimentary lounge access in India with Mastercard at select airports

International Lounge Access

NA

Golf

NA

Insurance Benefits

NA

Spend-Based Waiver

NA

Rewards Redemption Fee

Rs 99 per redemption request

Foreign Currency Markup

3.5% on the conversion amount

Interest Rates

3.5% per month (42% per annum)

Fuel Surcharge

1% surcharge waiver on fuel transactions at all fuel stations across India

Cash Advance Charges

2.5% on the transaction amount subject to a minimum charge of Rs 500

- Exclusive shopping e-Gift vouchers worth Rs 3000 from any partner exclusive

- 1 Point per Rs. 100 spent on other retail outlets

- 3x points on Dining, Departmental & Grocery shopping, and International spends

- 8 complimentary lounge access in India with Mastercard at select airports

- Get an e-Gift voucher worth Rs 3000 from the partner exclusives on annual spending of Rs 4 lakhs and 5 lakhs each

- 2% value back on spends on Croma and croma.com & upto 5% value back on spends on Tata outlets

- 1% surcharge waiver on fuel transactions at all fuel stations across India

SBI Tata Platinum Card Rewards

- You can earn 3 Empower points on Dining, Departmental & Grocery shopping, and International spends

- You get 1 Empower point on every Rs 100 spent on other retail categories.

- You earn 1 Empower point on every Rs 100 spent on retail stores

- 1 Empower point = Rs 1

Welcome Benefits

As a welcome benefit, you get exclusive shopping e-Gift vouchers worth Rs 3000 from any partner exclusive such as Yatra, Hush Puppies / Bata, Aditya Birla Fashion, Westside. In addition to this, you get an anniversary gift on spending Rs 2 lakhs in the previous year. The information regarding the voucher code shall be communicated within 15 days of the payment of the joining fees.

Milestone Benefits

You get an e-Gift voucher worth Rs 3000 from the following partner exclusives Yatra, Hush Puppies, Bata, Westside, Aditya Birla Retail on annual spending of Rs 4 lakhs and 5 lakhs each. The information regarding your e-gift voucher will be communicated via SMS at your registered mobile number with 7 working days.

Travel Benefits

With this card, you get 8 complimentary lounge access in India with Mastercard. You are allowed a maximum of 2 lounge access per quarter.

Fuel Surcharge Waiver

You get a 1% surcharge waiver on fuel transactions at all fuel stations across India. The waiver is applicable on transactions between Rs 5,00 to Rs 4,000. You get a maximum surcharge waiver of Rs 250 per statement cycle.

Value Back Benefits

You can get up to 2% value back on spends on Croma and croma.com and upto 5% value back on spends on Tata outlets.

Conclusion

SBI Tata Platinum Card is an entry-level card best suited for beginners offering them a wide array of benefits and privileges on their spendings. With your SBI Tata Platinum, you get accelerated rewards i.e. 3x Empower points on every Dining, Departmental & Grocery shopping, and International spends. 1 Empower Point = Rs 1, which is a decent reward rate and can be redeemed through the TATA rewards loyalty program. You get milestone rewards on spending Rs 4 lakhs and 5 lakhs each, you get an e-Gift voucher from the partner exclusives. What do you think about this credit card? Do let us know in the comments.

FAQs:

What is monetary rate of the empower points accured?

How much value back do you get on spend on TATA outlets?

What is the interest rate charged on this credit card?

Do I get a spend based waiver on this credit card?

Do I get charged a separate cash advance charge on transaction made through an International ATM?