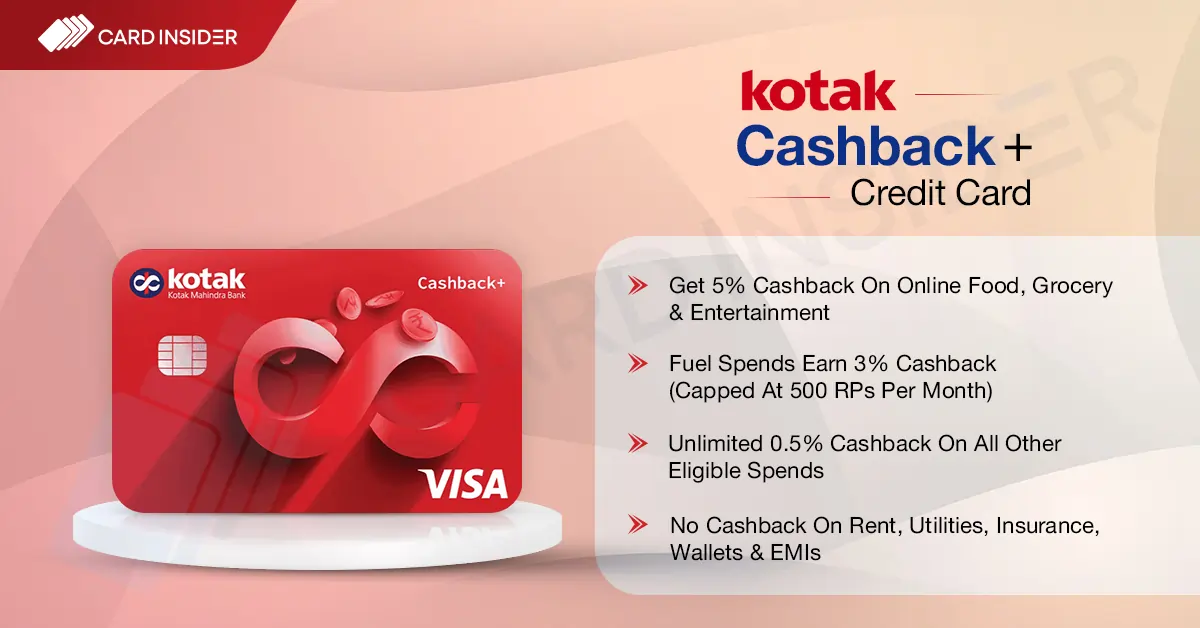

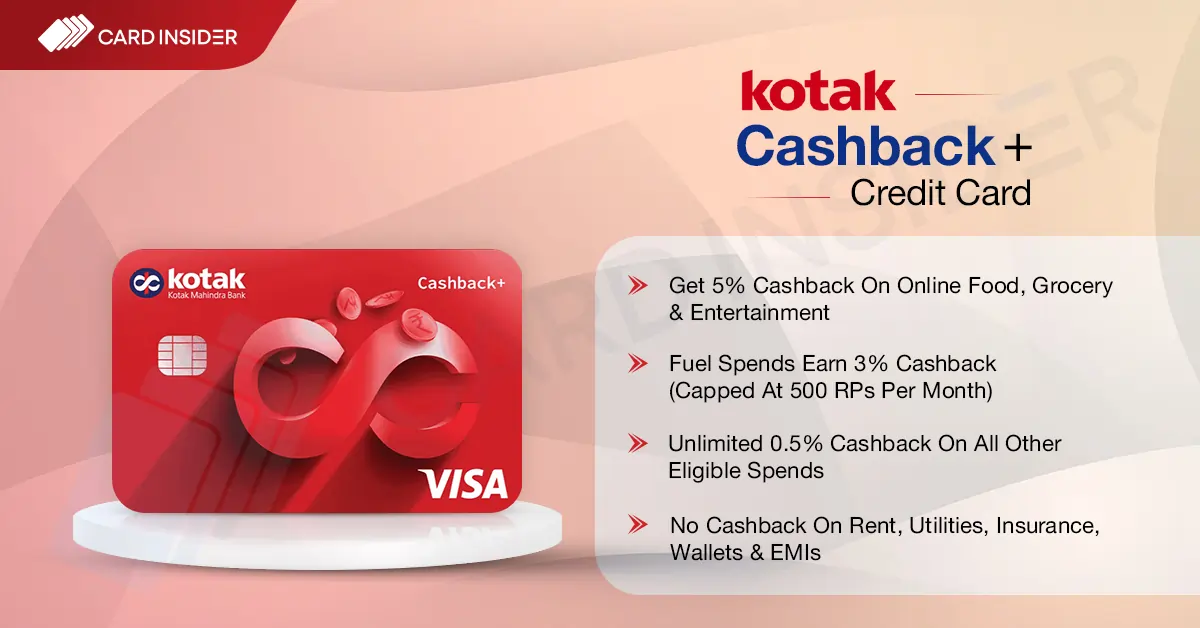

Kotak Cashback+ Credit Card

Joining Fee

Renewal Fee

Best Suited For

Reward Type

|

Welcome Benefits

Movie & Dining

N/A

Rewards Rate

5% Cashback on Online Food, Grocery, and Entertainment. 3% Cashback for Fuel and Unlimited 0.5% Cashback for Other Categories

Reward Redemption

Redeem Points as Cashback. 1 Reward Point = ₹1

Travel

N/A

Domestic Lounge Access

N/A

International Lounge Access

N/A

Golf

N/A

Insurance Benefits

N/A

Spend-Based Waiver

On Spends of ₹2 Lakh Each Year

Rewards Redemption Fee

N/A

Foreign Currency Markup

3.5%

Interest Rates

3.75/Monthly and 45% Yearly

Fuel Surcharge

1% Waiver on Transactions Between ₹500 and ₹4000

Cash Advance Charges

N/A

- The Kotak Cashback+ Credit Card, as the name suggests, is a dedicated card for cashback.

- This card offers 5% cashback for online food delivery, entertainment, and groceries.

- Cardholders will also earn 3% cash back on fuel spends and unlimited 0.5% cash back on all other eligible purchases.

Pros

- The Kotak Cashback+ Credit Card is an entry-level credit card and would be most suited for those with mediocre spends.

Cons

- There are no renewal or welcome benefits associated with this card.

Up to 5% Cashback for Select Spends

- 5% accelerated cashback on online food & grocery delivery, and online entertainment spends.

- 3% accelerated cashback on fuel spends. Both these accelerated categories have a cap of 500 Reward Points per statement cycle. No Reward Points are earned for the accelerated categories after reaching the cap.

- Unlimited 0.5% cashback on all other eligible spends.

- No cashback will be awarded for rent payments, B2B transactions, utility bill payments, insurance payments, education-related payments, government-related payments, wallet reloads, online skill-based gaming, or any transaction converted to EMI.

1 Reward Point = ₹1

How to Redeem Cashback?

Reward Points can only be redeemed as cash back.

- Open the Kotak Rewards Platform.

- Click on the hamburger icon in the top left corner and select “Login.”

- Enter your CRN in the “Enter CRN” field and click on “Get OTP.”

- You will receive an OTP on your registered mobile number and email ID.

- Enter the OTP in the “Enter OTP” field and click on “Submit.”

- Since the accrued points can only be redeemed as cashback, select “Credit Card” from the “Card Type” dropdown menu.

- Choose your Cashback+ card from the “Card Number” dropdown.

- Enter the number of reward points you wish to redeem.

- Accept the terms and conditions and click on “Submit.”

Unclaimed cashback shall expire in one year.

Fuel Surcharge Waiver

A 1% fuel surcharge waiver will be available on transactions between ₹500 and ₹4,000. The maximum waiver allowed is up to ₹3,500 in a single anniversary year.

Bottom Line

The Kotak Cashback+ Credit Card is a straightforward and simple card that offers accelerated reward points, which can be redeemed as cashback for spends on online food/grocery delivery, entertainment, and fuel. While fuel spends earn 3% cashback, other eligible categories earn 5% cashback. Both these accelerated categories are capped at 500 Reward Points per statement cycle, amounting to potential savings of up to ₹6,000 per year.

The card comes with a joining and annual fee of ₹750 + GST and does not offer any welcome or renewal benefits. It can be a good choice for those beginning their credit card journey and spending in the accelerated categories. However, seasoned credit card users may find better value in other individual cards like SBI Cashback or well-planned credit card combos.

FAQs:

What is the joining charge for this card?

Do I earn unlimited cashback for fuel?

What are the charges for cashback redemption?