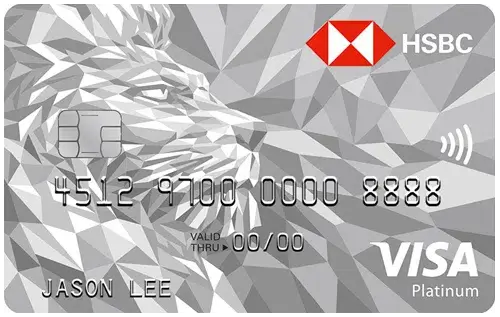

HSBC Visa Platinum Credit Card

Apply Now

Joining Fee

Renewal Fee

Best Suited For

Reward Type

Welcome Benefits

Movie & Dining

BOGO on Movie Ticket Bookings via BookMyShow. Upto 15% Dining Discounts via EazyDiner

Rewards Rate

2 Reward Points/₹150 Spent

Reward Redemption

Redeem Reward Points for Gift Vouchers, Airmiles, and More

Travel

NA

Domestic Lounge Access

NA

International Lounge Access

NA

Golf

NA

Insurance Benefits

NA

Spend-Based Waiver

N/A

Rewards Redemption Fee

Nil

Foreign Currency Markup

3.50% on all international spends

Interest Rates

3.49% p.m. (41.88% p. a.)

Fuel Surcharge

1% fuel surcharge waiver at all fuel stations in India.

Cash Advance Charges

2.5% of the advance amount or Rs. 500, whichever is higher.

- There is no joining and annual fee.

- 5X reward points on crossing annual spending of ₹4,00,000 (Upto 15,000 Reward Points).

- 2 Reward Points on every other ₹150 spent on this card.

- Buy 1 get 1 offer on booking movie tickets through BookMyShow.

- 1% fuel surcharge waiver.

HSBC Visa Platinum Credit Card Features

The Visa Platinum Credit Card offered by HSBC is an entry-level offering by the bank, and it is among the most popular lifetime free credit cards in India. With a zero annual fee, it provides you with a decent reward rate and several other benefits across a few more categories, including entertainment, lifestyle, etc. The detailed features and benefits of this card are given below:

Movie & Dining benefits

You get a “Buy 1 Get 1” offer on booking movie tickets on Saturdays through BookMyShow. The maximum discount limit is capped at ₹250.

HSBC Visa Platinum Credit Card Rewards

The reward rates offered by the HSBC Visa Platinum Credit Card in different categories are mentioned below:

- You earn 2 Reward Points on every spend of ₹150.

- You can earn 5X reward points upto 15,000 points after crossing the total spends of ₹4,00,000 in an anniversary year.

Reward Redemption

- You can redeem your reward points under the HSBC Credit Cards Rewards Programme for gift vouchers, cosmetics, home appliances, donations, etc.

- On the HSBC Visa Platinum Credit Card, you can easily convert your reward points into AirMiles (InterMiles/ British Airways/Singapore Airlines).

| Airlines/Membership Programme | Conversion Ratio |

| Maharaja Club | 2 Reward Points = 1 Maharaja Club Point |

| Singapore Airlines (Kris Flyer) | 2 Reward Points = 1 Kris Flyer Mile |

| British Airways Executive Club (Avios) | 2 Reward Point = 1 Avios Mile |

| Etihad Airways | 2 Reward Points = 1 Airmile |

| InterMiles | 2 Reward Points = 1 InterMile |

HSBC Bank Visa Platinum Credit Card Fees & Charges

The Visa Platinum Credit Card by HSBC has some important fees and charges associated with it, and the most important charges of this card are as follows:

- The HSBC Visa Platinum Credit Card has no joining/annual fee; i.e., it is a free lifetime credit card.

- The interest rate on this credit card is 3.49% per month, which is charged on the outstanding amount of your card after the payment due date.

- The cash advance fee on the Visa Platinum Credit Card is 2.5% of the amount withdrawn, subject to a minimum fee of ₹500.

- The foreign currency markup fee on this card is 3.5% of the total amount that has been spent in foreign currency transactions.

HSBC Visa Platinum Credit Card Eligibility Criteria

In order to get approved for the Visa Platinum Credit Card by HSBC, you will have to follow certain eligibility criteria, which are mentioned below:

- The age of the applicant should lie between 18 years and 65 years.

- The applicant should have a stable source of income with a minimum monthly income of ₹4 lakhs.

- This card is issued to salaried individuals only. Self-employed people can apply only if they have a savings/current account in HSBC.

- The applicant should be an Indian resident.

- The applicant should be from one of these cities: Bengaluru, New Delhi, Gurugram, Hyderabad, Mumbai, Chennai, Noida, Kolkata, Pune, Chandigarh, Jaipur and Ahmedabad.

How to Apply for The HSBC Visa Platinum Credit Card?

If you fulfill the above-mentioned eligible criteria, you can apply for the card online as well as offline at your convenience. To apply offline, visit your nearest HBC branch (if there is one in your city) with the necessary documents and apply for the card by filling out the physical application form. To apply online, follow the steps given below:

- Click on ‘Apply Now.’

- Start your application by entering your name & mobile number and proceed further.

- Enter your Aadhaar-linked mobile number.

Conclusion

HSBC Bank has launched the HSBC Visa Platinum Credit Card, keeping in mind the requirements of those who want to have a lifetime free credit card with maximum saving opportunities. Even after being a card with no joining fee, the card provides its customers with some exclusive welcome benefits, which is one of the exceptional features of the card.

Moreover, you can enjoy accelerated reward points once you reach a total spend of ₹4 lakhs. Being a no-annual-fee credit card with decent benefits, it gives direct competition to some other popular cards like the ICICI Platinum Chip Credit card. Keeping all these advantages of this card in mind, the card can be considered an excellent choice for people who are looking for an affordable card with multiple exciting benefits. This was our review of the HSBC Visa Platinum Credit Card. Make sure to let us know your views on this in the comment section below!

FAQs:

Do I get any lounge access under travel benefits on the HSBC Visa Platinum Credit Card?

What are the eligibility criteria for HSBC Visa Platinum Credit Card?

Is there a redemption fee for this card?

How much does HSBC Bank charge a foreign currency markup fee on this card?