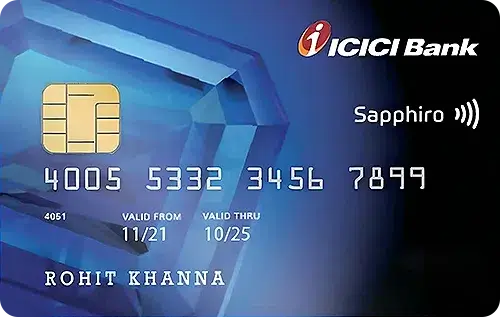

ICICI Bank Sapphiro Credit Card

Apply Now

Joining Fee

Renewal Fee

Best Suited For

Reward Type

Welcome Benefits

Movie & Dining

Get Rs. 500 off on the second movie or event ticket when you buy one ticket from Book My Show.

Rewards Rate

On every Rs. 100 spent, get 4 Reward Points per Rs. 100 spent on international purchases & 2 Reward Points on domestic purchases.

Reward Redemption

Redeem reward points earned for cash back or gifts at a rate of 1 RP = Re. 0.25

Travel

Complimentary Priority Pass Membership

Domestic Lounge Access

4 Complimentary Domestic Lounge Visits Each Quarter

International Lounge Access

2 Complimentary International Airport Lounge Access Each Year

Golf

Complimentary golf rounds/lessons every quarter

Insurance Benefits

Air accident insurance (worth Rs 3 crores), Credit Shield Cover worth Rs 50,000 and other travel-related Insurance Covers.

Spend-Based Waiver

Renewal fee waiver on spending Rs 6 Lakhs annualy.

Rewards Redemption Fee

₹99 + GST

Foreign Currency Markup

3.50% of the total transaction value.

Interest Rates

3.4% per month (or 40.8% per annum)

Fuel Surcharge

1% of Fuel Surcharge Waiver (Maximum Rs 250 per billing cycle) at all fuel stations in India.

Cash Advance Charges

2.5% of the total transaction amount (minimum Rs. 300)

- Joining benefits worth more than Rs. 9,000.

- You can earn up to 4 Reward Points for every Rs 100 you spend on international purchases and 2 Reward Points per Rs 100 you spend on domestic purchases.

- 1 Reward Points for every Rs. 100 you incur on insurance and utility categories.

- Up to 20,000 bonus Reward Points every year under the Milestone Reward Program.

- (Buy 1 Get 1 Free Offer) BOGO on movie tickets on BookMyShow.

- Get complimentary lounge access within and outside India and have spa sessions at selected domestic airports.

- With the ICICI Sapphiro Credit Card, you can enjoy complimentary golf sessions up to four times a month at some of the finest golf courses worldwide.

ICICI Sapphiro Credit Card Features & Benefits

The Sapphiro Credit Card by ICICI Bank has various benefits in various categories, including reward programs, travel, airport lounge access, entertainment, dining, and many more. To understand all its benefits in detail, go through the information provided below:

Welcome Benefits

- You get complimentary gift vouchers/loyalty program membership as a joining benefit within 45 days of realizing your card membership.

| Gift Voucher/Membership | Worth of Voucher/Membership |

| Tata CliQ Voucher | ₹3,000 |

| Croma Voucher | ₹1,500 |

| EaseMyTrip Voucher | ₹4,000 |

| Uber Voucher | ₹1,000 |

Milestone Benefits

With the ICICI Bank Sapphiro Card, you earn 4,000 Reward points on spending ₹4 lakhs in an anniversary year, and after that, you get 2,000 RPs every time you spend ₹1 lakh with your card. You can earn a maximum of 20,000 Points per anniversary year under the Milestone Reward Program.

Travel Benefits

ICICI Bank Sapphiro Credit Card entitles you to complimentary visits to domestic and international airport lounges with Visa/MasterCard/American Express/RuPay variants, along with a free Priority Pass membership.

Visa/MasterCard/AmEx/RuPay Airport Lounge Access Program

- Under the Visa/MasterCard/AmEx/RuPay lounge access program, your ICICI Bank Sapphiro Credit Card gives you four complimentary access to select partner domestic airport lounges.

- The four complimentary domestic lounge access benefits only apply if you spend ₹75,000 with the card in the preceding quarter.

Priority Pass Membership

- You get two complimentary international lounge accesses every year at partner lounges worldwide, as well as a complimentary Priority Pass lounge access program membership.

- The lounge visits are complimentary only for the primary cardholder. Any accompanying guest (including any of the add-on cardholders) will have to pay.

Movie & Dining

- Get one movie ticket free every time you buy one ticket via BookMyShow.

- The complimentary movie ticket price should be below ₹500, and the offer can be availed two times a month.

- ICICI Bank Sapphiro Credit Card allows you to enjoy your favorite delicacies by availing of exclusive offers and benefits with the ICICI Bank Culinary Treats Programme.

Golf Benefits

- ICICI Bank Sapphiro Credit Card entitles you to complimentary golf rounds/lessons at some of the most premium golf courses in the country per ₹50,000 spent in the preceding quarter. Golftripz provides this golf benefit.

- A maximum of 4 complimentary golf rounds/lessons can be availed in a given quarter.

- Cardholders must register their credit cards on the official Golftripz website to avail of the golf benefit.

- The complimentary rounds/lessons of golf are visible in the Golftripz account only after the 10th of the next month. These complimentary golf games are available to be played anytime in the next two months.

Insurance Benefits

Following are the insurance benefits associated with the ICICI Bank Sapphiro credit card:

| Insurance | Coverage |

| Personal Air Accident | ₹3 Crore |

| Baggage insurance | Up to ₹25,000 |

| Loss of checked-in baggage | USD 1200 |

| Delay in receipt of checked-in baggage | USD 300 (in excess of 12 hours) |

| Missing flight due to trans-shipment | USD 300 |

| Loss of travel documents | USD 500 |

| Delay in flight | USD 250 (in excess of 12 hours) |

| Plane hijacking | USD 250 Per Hour (up to max 12 Hrs.) |

Concierge Service

ICICI Bank Sapphiro Credit Card offers 24×7 concierge services and assistance regarding:

- Flight referral and reservation.

- Hotel and restaurant reservations.

- Flowers and gifts.

- Booking and delivery of movie tickets.

- Medical Concierge services.

ICICI Bank Sapphiro Credit Card Rewards

- With the ICICI Bank Sapphiro Credit Card, you can earn 4 Reward Points every time you spend ₹100 on international transactions.

- You earn 2 Reward Points per ₹100 spent on domestic purchases except for fuel.

- You can also get 1 Reward point per ₹100 spent on utilities and insurance.

Reward Redemption

With ICICI Bank Sapphiro Credit Card, you can redeem your earned reward points against your card’s statement balance or purchase gifts as follows:

- To redeem your Reward Points against cash, call 080-40146444. Your points will be credited as cash credit to your account within 7 days of the redemption request.

- For redemption against gifts, call 1860-258-5000. The gift of your choice will be sent to you within ten working days.

ICICI Sapphiro Credit Card Fees & Charges

- The ICICI Bank Sapphiro Card joining fee is ₹6,500, and the annual fee is ₹3,500 from the second year.

- The interest rate applicable with the card is 3.4% per month (40.8% annually).

- If you withdraw cash using your ICICI Bank Sapphiro Credit Card, you must pay a cash advance fee of 2.5% or ₹500 (whichever is lower).

- A forex markup fee of 3.5% is charged for foreign currency transactions.

ICICI Sapphiro Card Eligibility Criteria

| Particular | Criteria |

| Age | Between 21 Years and 65 Years |

| Income | Stable source of Income |

| Credit Score | Decent credit score (750 or above) |

How To Apply For ICICI Sapphiro Credit Card

The ICICI Bank provides both online and offline methods to apply for the Sapphiro credit card. If you prefer offline methods, simply visit your nearest branch and apply for the card. You can also apply online by following the steps given below:

- Click on Apply Now.

- An application form will appear on your screen. Fill that carefully.

- Proceed further by submitting all your required documents and completing the process.

Application Status

- The easiest and fastest way to track your ICICI Credit card application status is to visit the official webpage to track an application. Where you can get the status of your credit card application by entering your registered mobile number, date of birth, and application number.

- If you don’t prefer online methods, you can visit the branch and ask the ICICI bank executives about your credit card application status.

How To Activate ICICI Sapphiro Credit Card

There are a lot of different ways to activate your ICICI Bank Sapphiro Credit Card, as follows:

- You can activate your card by logging in to the net banking account and then finding the option for PIN generation.

- A new card can also be activated through an ICICI Bank ATM. Visit your nearest ATM and click on the option ‘Create PIN using OTP.’ Make sure that you have the registered mobile number when activating the card.

- You can also use the ICICI Bank Mobile app, which was created to facilitate banking services for customers.

- Another option for credit card activation is to reach out to your credit card customer care and ask them to guide you.

ICICI Sapphiro Credit Card Customer Care

- If you have any doubts or queries related to your ICICI Sapphiro Credit Card, you can contact the bank’s customer care at 1860 120 7777. This number is available every day from 9:00 am to 7:00 pm.

- To contact ICICI Bank customer care by mail, send your query to [email protected] along with all your personal and account details.

Cards Similar To ICICI Sapphiro Credit Card

The following are some of the popular cards that are comparable to the Sapphiro Credit Card. We have compared them based on different factors, including annual fee and their benefits, in the table given below:

| Credit Card | Annual Fee | Reward Rate | Main Benefits |

| ICICI Sapphiro Credit Card | ₹3,500 | Up to 4 Reward Points on every international spend of Rs. 100.Up to 2 Reward points on every domestic spend of Rs. 100. | Complimentary domestic and international airport lounge access.Buy 1 get 1 free offer on movies on BookMyShow.

Up to 20,000 Reward Points every year on achieving the spend milestone. |

| HDFC Infinia Credit Card | ₹12,500 | 5 Reward Points on every spend of Rs. 100.2x Reward Points on dining.

10x Reward Points on the SmartBuy portal. |

Unlimited complimentary domestic and international lounge access. |

| SBI Elite Credit Card | ₹4,999 | 2 Reward Points on every spend of Rs. 100.5x Reward Points on dining, groceries, and departmental stores. | Complimentary domestic and international lounge access is available every year.Complimentary movie tickets every month.

Up to 50,000 bonus reward points will be awarded to those who achieve the spending milestone. |

Is This The Right Card For You?

Different credit cards can be best suited for individuals as everyone’s requirements vary. Before applying for the ICICI Sapphiro Credit Card, you must check whether it fits your needs. You need to analyze your spending habits first in order to understand the categories where you spend the most. After that, go through all the features of the Sapphiro Credit Card. If you think it fulfills all your expectations and is affordable, you can apply for it. But compare it with a few similar cards before making any decision.

Conclusion

One of the most premium offerings by ICICI Bank, the ICICI Bank Sapphiro Card, is undoubtedly a significant choice for individuals who believe in having a credit card with multiple benefits over different categories, including reward offers, travel, entertainment, dining, etc. This card rewards you for all the domestic and international spending you make using it. Moreover, the ICICI Bank Sapphiro Credit Card allows you to enjoy your favorite delicacies by availing of exclusive offers and benefits, including a 15% saving on bills under the ICICI Culinary Treats Programme at more than 2,500 restaurants all over India.

You can also avail of 2 complimentary movie tickets worth ₹500 each, saving you up to ₹12,000 annually. Regarding its travel benefits, the card provides complimentary domestic and international lounge visits every year, making your travel experiences even more luxurious. However, the joining fee is relatively high, which is offset by the welcome benefits provided, and the annual fee is relatively affordable. All these privileges make this card worth applying for.

FAQs:

What is the validity of Reward Points?

Do I get a fee waiver on the renewal of a credit card?

Do I get Personal Accidental Insurance with this card?

Is ICICI Sapphiro Credit Card free?

Is ICICI Sapphiro Credit Card International?

What is the interest rate on the ICICI Sapphiro Credit Card?

Can I withdraw cash using ICICI Bank Sapphiro Card?